Who Will Pay by Bank?

Innovation

Payment innovation

Europe

United Kingdom

Token

Aug 16, 2022

Surveys

Ultimately, in the world of payments, success depends on human factors, like how consumers perceive and respond to risk, reward and effort.

Against this backdrop, Token surveyed over 1,000 people across Europe about the attitudes, preferences and behaviours shaping their financial and digital lives.

Token presents: "Who Will Pay by Bank" a data-driven look at the human element that will fuel the future of open banking payments.

A glimpse into this report:

- Learn which consumers are paying by bank today and where will we see demand tomorrow

- Discover the behaviours and opportunities that could support continued uptake of account-to-account (A2A) payments

- Understand how consumers in Europe perceive the benefits of A2A payments and other payment methods on a country-by-country basis

- Uncover how consumers understand open banking's evolving role in their lives

- Read commentary from the Open Banking Implementation Entity, Open Banking Expo, American Express, Ban

Some content is hidden, to be able to see it login here Login

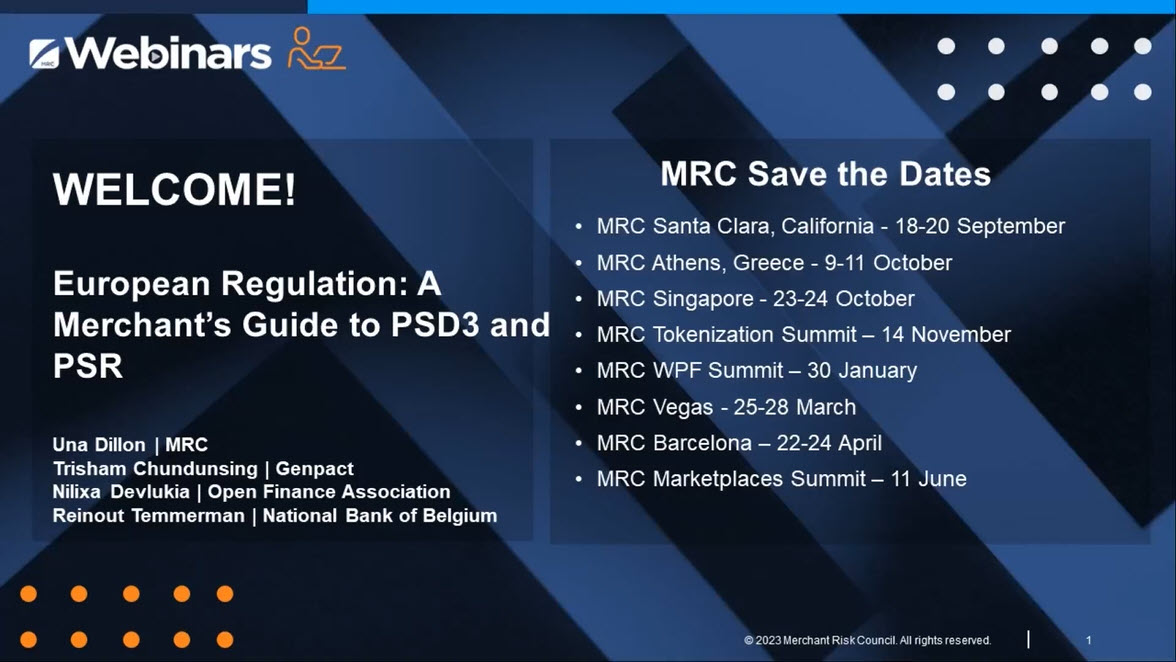

Host a Webinar with the MRC

Help the MRC community stay current on relevant fraud, payments, and law enforcement topics.

Submit a Request

Publish Your Document with the MRC

Feature your case studies, surveys, and whitepapers in the MRC Resource Center.

Submit Your Document

Related Resources

There are no related Events

There are no related Surveys