Will Cryptocurrency be the Cash of the Future?

We discuss what cryptocurrency is, what it isn’t, central bank digital currencies, and what merchants need to know about the future of digital payments.

By Joshua Pynn, Strategic Insights Consultant at CMSPI

What is Cryptocurrency?

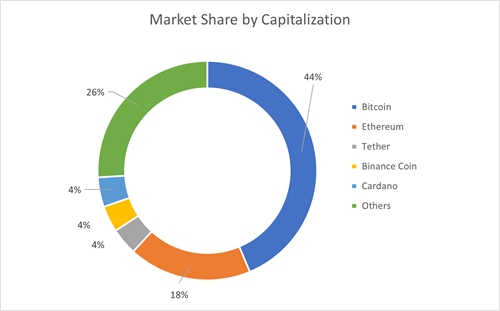

Cryptocurrency is a digital, software-based financial asset that has attracted the eye of investors, the public and merchants since the inception of Bitcoin in 2009. Since Bitcoin’s creation, more than 4,000 other digital currencies of various forms, capabilities and popularity have been created, leading to a market capitalization of over $2 trillion. Cryptocurrencies are polarizing because of their immense volatility. But the core of the crypto experiment is blockchain, a highly secure data technology that is finding increasing uses in everything from financial transactions to tracking the movement of goods through global supply chains.

Cryptocurrency is:

- Fully digital: Ultimately, cryptocurrency is a collection of 1s and 0s.

- An asset: Legally, it is a financial asset rather than currency.

- Independent: It is not backed by any central authority (except for a few rare cases).

Cryptocurrency is NOT:

- Money

- Central Bank Digital Currencies

What is a CBDC?

Central bank digital currencies are cryptocurrencies issued by central banks, and have been directly inspired by Bitcoin and its immense public demand. CBDCs are not nearly as widespread as other cryptocurrencies and only a few, like China’s digital renminbi/yuan (known as E-RMB or E-CNY), have gone beyond the discussion stage and actually been implemented. Fundamentally, CBDCs look to take advantage of the unique and inventive blockchain system while tackling the downsides of cryptocurrencies. Over 80% of central banks in the world are currently assessing the viability of a digital currency to supplement or potentially replace traditional paper currency, so there will likely be substantial growth in the coming years.

CBDCs are:

- Stable: Because they are backed by a government, they are not as volatile as cryptocurrencies.

- A potential replacement for paper money: Cash reserves could be moved to a digital form.

- Subject to inflation: CBDCs can be devalued over time with standard monetary policy.

CBDCs are NOT:

- Money, at least not yet: Money in an economic sense needs to meet three criteria to be effective: it must be a unit of account, a medium of exchange, and a store of value. Because of volatility, lack of widespread availability and still-limited acceptance in the marketplace, both cryptocurrencies and CBDCs currently fail one or more of those criteria. CBDCs have the most potential to become effective forms of money, but there are still many hurdles to overcome before that happens.

What might the future look like?

The idea of digitizing currency worldwide is an attractive one. Government payments such as Social Security or unemployment insurance benefits have been made by digital forms such as direct deposit rather than paper check or cash for many years. The same is true of most employer paychecks, and many consumers pay their bills electronically.

The pandemic has accelerated digital payments and the practices are likely to be sustained. In addition, much of monetary policy is currently enacted digitally, with the purchase and sale of government bonds occurring instantly. Meanwhile, digital purchase options such as digital wallets, mobile apps and QR codes are already widespread in the retail market, also accelerated by the pandemic.

That is good news for a digital “cash” future because the infrastructure for digital payments will have been developed before acceptance of digital currencies becomes ubiquitous among retailers. In an entirely digital economy, merchants will have to be at the forefront of acceptance and adoption for digital currency to function effectively.

For the latest in payments news and trends, read our current edition of Insights Magazine: https://insights.cmspi.com/link/42402/