What Payments Leaders Are Saying About PSP Dependencies and How Agnostic Tokenisation Can Solve It

Summary:

- What payments leaders are saying about PSP dependencies

- Reducing dependencies on a single PSP

- What is agnostic tokenisation and how can it help

Why does this matter?

Picture this: you are a customer at the point of e-checkout, your selected items are in the basket, you’ve proceeded through the data entry process and now you hit the “Pay now” button. Nothing happens…. At this point, if you behave like the average customer, you will leave the site and never return. 62% of shoppers who experience a failed transaction caused by PSP downtimes or other reasons will not return to the same website to try again.

For any business operating in today’s online-centric consumer environment, the pressure is on to ensure that every payment transaction is processed quickly, securely and without a hitch. According to chaos engineering platform, Gremlin, a minute of downtime would cost Walmart over $40,000, while Amazon is risking no less than $220,000. Even if the outage only lasted a few minutes, it will take a lot of time and effort to solve the problem, resolve the disputes, recoup the losses and regain customers’ and partners’ trust. This article draws on guidance from a top fintech consultancy and conversations we’ve had with experts across the industry to answer your questions about why PSP dependencies need to be avoided, and how.

What payments leaders are saying about PSP dependencies

The key to ensuring the security and success of each transaction is to avoid becoming locked into one PSP or having a single point of failure in your payment flows.

We recently worked with top fintech consultancy firm, Flagship Advisory Partners, on a project to identify the main pain points for payment leaders of medium and large e-commerce businesses. They spoke to a range of payments leaders, some with complex, international payment flows and summarized their pain points. When asked about PSP dependencies, their priorities included: firstly, a desire to own the payments value chain as much as possible but outsource specific services; and secondly, a desire to avoid relying on one or multiple PSPs. The situation of having “all eggs in one basket” is to be avoided.

Reducing dependencies on one or more PSPs

Everyone agreed that you must avoid dependencies on a PSP to scale a business and its payment flows. To ensure high availability, reasonable payment conversion rates, and many payment methods available to customers around the globe, most larger e-commerce businesses work with between 3 – 6 payment providers.

Then the challenge comes when you have to manage multiple checkout pages and integrations, PSPs producing different tokens which don’t work together and thus cannot be used to build failovers, dealing with PSPs not supporting up to date 3DS versions or network tokenisation… the list goes on. Under these circumstances, providing a consistent customer experience and maintaining the profitability of payment flows can feel like an uphill struggle.

So what’s the solution?

That’s when organisations usually look into building their own payment stack (in-house) or using a payment orchestrator (outsourcing). Building their own payment stack by owning the checkout forms, PSP integrations and routing logic sounds ideal for bigger merchants and allows them to maintain complete control. However, it also requires expert know-how, development efforts, additional compliance requirements and taking on all the security risks. Then there is the option of using a payment orchestrator. Payment orchestration solutions are on the rise and providers such as IXOPAY, Primer or ProcessOut are providing smart routing solutions and integrations to preferred PSPs out of the box. Ultimately, this gives you the chance to automatically switch PSPs to build failovers and reduce dependencies. However, because an outage of the orchestrator would directly impact your revenue, you will also lose ownership and control over your payment flows. Finally, there is the possibility to build a hybrid setup, by owning parts of the payment stack while using an additional payment orchestration layer for specific regions or use cases.

How tokenisation can help

For those organisations wanting to keep control of their payment flows and manage their relationships with PSPs or orchestrators, the most suitable approach is a hybrid DIY and buy option. We speak to businesses every day with various use cases. Some do everything in-house; others work with a combination of PSPs and orchestrators. Regardless of the setup, these businesses aim to provide a consistent and secure checkout experience for their customers, high availability, and low transaction fees.

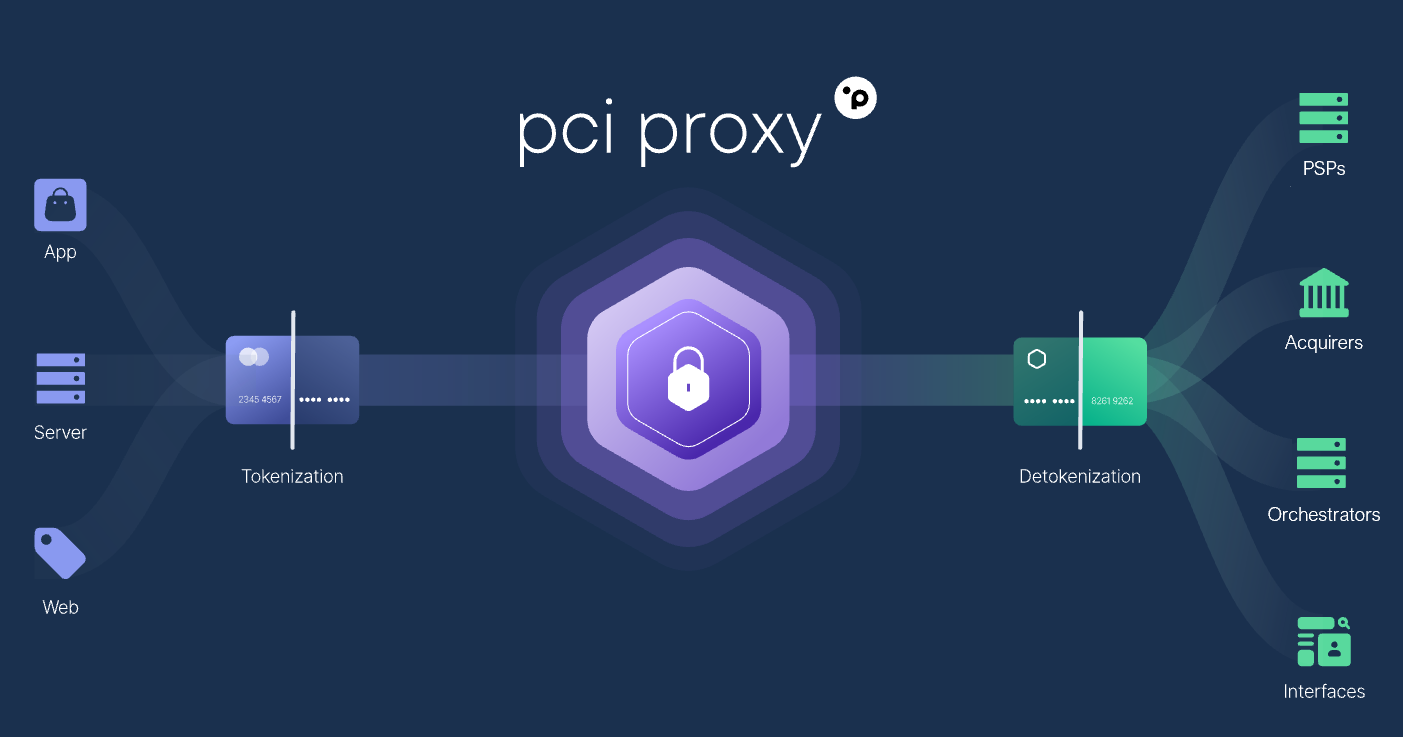

This is where tokenisation technology can make a difference. By deploying a PSP agnostic tokenisation system across your payment stack, businesses can address many of the outlined challenges.

A completely PSP-agnostic tokenisation system allows businesses to develop and maintain control over their payment flows. Use seamless integration techniques to tokenise payment data during checkout and create an agnostic token which can be used with any PSP or gateway. By doing this, you remove the need to map different tokens from various PSPs to one another. It is important to find an independent tokenisation provider which enables fast go-live times and will allow you to add existing and new PSPs as you scale.

About PCI Proxy

PCI Proxy empowers businesses of all sizes to build and maintain secure and reliable payment flows. We offer modular, componentised payment solutions to merchants who want to own their payment value chain as much as possible. This includes our truly universal token vault which significantly reduces the cost and hassle of PCI compliance, removes the risk of data breach and prevents provider lock ins. We enable our clients to build their own seamless checkout flows to collect and store sensitive payment data in a tokenised format and allow them to use tokens across PSPs or orchestrators without changing integrations or becoming locked in to one provider. On top of that, we employ leading-edge technologies such as 3-D Secure, network tokenisation, fraud prevention and more that can be used in combination with our vault to mitigate fraudulent activities and boost your payment conversion.

PCI Proxy’s agnostic tokens can be used with any PSP or PCI-compliant endpoint so our clients can keep control of their payment flows in-house.

Contact us:

You can contact us via the form on the website HERE.

Or email us at: sales@pci-proxy.com

Author

Sascha Huwyler, Head of PCI Proxy