Improving customer experience (along with vigilance) can curb first-party fraud

Online merchants are continuously looking to reduce fraud at every step of the online ordering journey. As ecommerce continues to become a bigger part of commerce overall, organized fraud rings and wayward consumers’ sophistication and brazenness are growing along with it.

Merchants are redoubling their fraud protection efforts beyond checkout to stop bad actors at the pre-purchase stage — think account creation and modification — and at the post-purchase stage — returns, refunds and consumer disputes.

In recent years, both Visa and Mastercard have announced changes aimed at helping merchants fend off illegitimate chargebacks filed by legitimate cardholders. And while the jury is still out on their effectiveness, the moves by major card brands is a clear indication that first-party fraud is on the rise.

Indeed for some time now merchants have been reporting that first-party fraud is growing faster than old-school payment fraud. In fact, Signifyd’s “The State of Fraud 2023” found that in 2022, first-party fraud was up 36% year over year, while payments fraud increased by 34%.

Also on the rise is a different type of scourge: return fraud. As online sales have grown, returns have ballooned. Between 2019 and 2021, retail returns grew by 3.5%, according to annual reports from the National Retail Federation. The online portion of those returns grew by more than 10%.

Not only that, but the NRF determined that in 2022, nearly 11% of those online returns were fraudulent, costing online merchants nearly $23 billion.

While updates to payment networks' dispute rules and technological advances are ever-changing ways that the industry is tackling the rise in first-party and return fraud, merchants have another tool in the arsenal; the customer experience.

The notion that merchants can reduce their chargeback rates by upping their customer experience game is yet another sign that contemporary fraud and risk intelligence teams have evolved well beyond solely playing defense. In fact, they are business optimizers who are in a unique position to see how poor customer experience leads to chargebacks, increased costs and lost revenue.

Today’s fraud fighters and risk intelligence teams are agile and focused on working across multiple teams to tamp down both the opportunities and the triggers that inspire customers to file illegitimate chargebacks.

None of which is to say delighting customers will mark the end of first-party fraud chargebacks. Risk intelligence teams need to remain vigilant, especially when it comes to determined, organized fraud rings — or individuals who are intent upon committing first-party fraud before they even place an online order.

But consider the first-party fraud chargebacks that stem from a frustrated customer’s desire to exact frontier justice by clawing back what they paid for a product that didn't live up to their expectations, or to simply be compensated for a delayed delivery or a poor customer experience post-purchase.

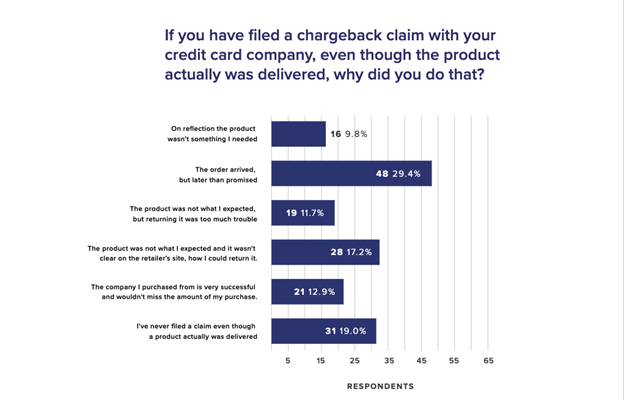

Avoiding those customer-experience fails can make a significant difference in the volume of chargebacks a merchant must deal with. In a 2020 consumer survey, Signifyd found that nearly 60% of respondents who had filed a chargeback had filed them because of a disappointing experience that the merchant could have avoided or mitigated.

"In particular, nearly 30% of customers said they filed a chargeback due to issues around late delivery, despite having received the purchased goods. More than 17% claimed the product they received wasn’t what they expected and they couldn’t figure out how to return it. Another 12% stated that the product wasn't as described pre-purchase and that returning the goods to the merchant was simply too much trouble for them.

Those are some pretty discouraging numbers, overall, unless you’re a glass-half-full type (or a fifth-full) who takes comfort in the fact that 19% of respondents said they’d never filed a chargeback when a product was successfully delivered.

Not to be a buzz kill, but there is another discouraging way to look at the evolution of ecommerce and the ways rightful cardholders find to run scams on merchants. When Signifyd conducted the 2020 survey, only 14% of respondents admitted to lying in order to keep a product and get a refund. When we asked a similar set of questions in 2022, 21% of respondents said they had tried to keep a product and get a refund by falsely claiming a package never arrived and 22% said they had done so by falsely claiming their delivered item was significantly not as described.

We will take a deep dive on this topic, along with others, at Signifyd’s annual FLOW Summit on April 17, in New York City. MRC members can register for free here using code MRC-flow-2024. In the meantime, here are ways merchants can protect themselves from the dramatic increase in first-party fraud and a subset of consumers who have grown bolder as more shopping has moved online:

- Start with clear descriptions and accurate product photos on your website. Making sure that your customers know what they're getting before they place their order helps them avoid being disappointed when the product arrives on their doorstep, which could prompt them to file a chargeback. Remember that nearly 12% of those surveyed said they filed a chargeback rather than return a product they were not satisfied with because returning the item was too much trouble.

- Develop easy return procedures and display them prominently on your website. Intentionally making your returns process difficult in order to discourage returns is sure to backfire. A return may not be ideal for either your customers or yourself, but it is the better option compared to a costly, potentially damaging chargeback. Remember that more than 17% of consumers said they filed a chargeback because they couldn't figure out how to return the product they deemed to be unsatisfactory.

- Pressure test your entire fulfillment infrastructure to make sure your systems are built to deliver on time even during peak season. Delayed orders often cause stress for consumers and prompt them to file a chargeback in order to get their money back.

- If shipment delays do arise, communicate quickly, clearly and frequently with customers, keeping them updated on the progress of their order. Customers understand that things sometimes go wrong; they just don’t like to be left in the dark. Knowing what is going on with an order is often enough to prevent a shopper from filing a chargeback when their order is delayed.

- Be available to answer customers' questions and concerns whether the questions are about the progress of an order or the product itself. Make sure your customers know how they can contact you should they need help with their order, and be sure your customer support staff is well-equipped to help with consumer concerns. If customers struggle to get in touch with you, they know they can go down the chargeback route instead which could become more costly and time-consuming for your company.

- Own your mistakes and make them right when you can. Adding a discount, a gift card or a small gift can go a long way in restoring goodwill in a customer’s mind.

- Be prepared to make your case if you believe a customer has filed a chargeback illegitimately. The major card brands — including Mastercard and Visa — have specific procedures laid out for disputing chargebacks. If you’re not already familiar with them, study up so that you know what documentation you’ll need before you actually need it.

- Take a holistic view of fraud. Don’t take your eye off of traditional payment fraud as you focus on first-party fraud. And consider the possibility that some first-party fraud might be committed or aided by professional fraud rings that have recruited legitimate cardholders to participate knowingly or unwittingly in their schemes. Fraud tactics and strategies are rapidly diversifying and evolving. Staying hyper-aware is key.

Want to learn more about the role of optimizing customer experience in curbing first-party fraud? Contact Signifyd.