Balancing Customer Experience and Fraud Prevention in Digital Payments

Introduction

Digital payments have revolutionized commerce, delivering unprecedented speed and convenience to consumers around the globe. According to McKinsey's 2024 Global Payments Report, the industry handled 3.4 trillion transactions in 2023, accounting for $1.8 quadrillion in value and generating $2.4 trillion in revenue. Yet, as adoption accelerates, so does the risk of fraud, creating a critical challenge for payment providers and merchants: how to deliver a seamless customer experience while maintaining robust fraud prevention measures.

Payment providers operate in an increasingly complex environment where implementing too many security measures can lead to abandoned transactions, while insufficient protection exposes customers to sophisticated fraud schemes. This delicate balance is particularly crucial as global payments revenue is projected to grow 5% annually through 2028. Success in this expanding market requires a sophisticated approach that protects transactions without sacrificing the speed and convenience that modern consumers demand.

The Friction Dilemma: When Security Meets Customer Patience

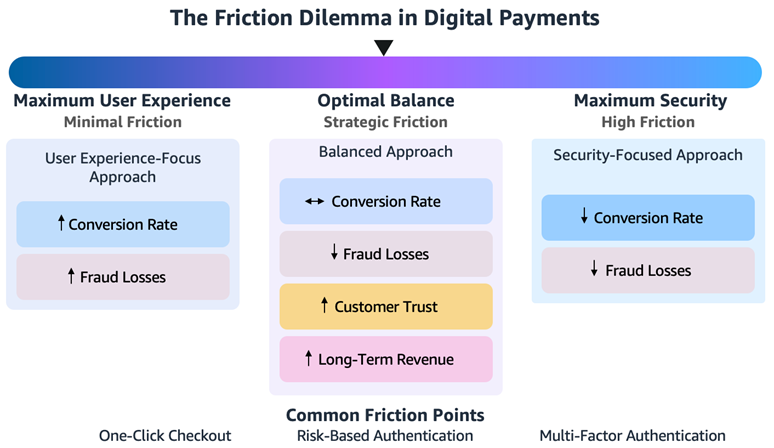

The digital payments ecosystem operates on a delicate fulcrum where security and user experience constantly counterbalance each other. On one side, streamlined experiences like one-click checkouts accelerate transactions and boost conversion rates—but potentially at the cost of security vulnerabilities. On the opposite end, robust protections such as multi-factor authentication effectively deter fraudsters while sometimes frustrating legitimate customers into abandonment.

The most successful payment providers don't view this as an either/or proposition but rather seek the equilibrium point where security measures are strategically implemented to protect transactions without unnecessarily burdening users. This balanced approach delivers strong fraud prevention while maintaining high conversion rates.

The Rising Tide of Digital Payment Fraud

Modern fraudsters employ an arsenal of evolving tactics—account takeovers, synthetic identity fraud, friendly fraud, and card testing schemes. Beyond direct financial losses, merchants face chargeback fees, operational costs for fraud investigation, and potential increases in processing fees. Perhaps most damaging is the erosion of consumer trust when fraud incidents occur, leading to brand damage that can take years to rebuild.

The challenge is particularly acute for small and medium-sized businesses that lack the resources for sophisticated fraud prevention but remain attractive targets for fraudsters seeking vulnerable systems.

Technology Solutions: Intelligence at the Core

Modern payment security is increasingly built on intelligent systems that can distinguish between legitimate customers and fraudulent actors without adding unnecessary friction:

Machine Learning and AI

Advanced algorithms analyze hundreds of transaction variables in milliseconds to detect unusual patterns without interrupting the customer journey. These systems continuously learn from new data, improving their accuracy in identifying emerging fraud techniques.

Behavioral Biometrics

Rather than relying solely on what customers know (passwords) or have (devices), behavioral biometrics analyze how users interact with their devices. The way someone types, holds their phone, or navigates a website creates a unique behavioral fingerprint that's difficult for fraudsters to replicate.

Network Intelligence

By analyzing patterns across entire payment networks, providers can identify fraud attempts targeting multiple merchants simultaneously. This network effect creates a powerful defense system where learning from one attack helps protect the entire ecosystem.

Tokenization and Encryption

These technologies protect sensitive payment data throughout the transaction lifecycle, rendering stolen information useless to criminals. Tokenization replaces actual card numbers with unique identifiers that have no inherent value if intercepted.

Strategic Implementation: The Risk-Based Approach

Rather than applying the same level of security to every transaction, a risk-based approach tailors verification requirements based on specific risk factors:

Contextual Authentication

By evaluating the context of each transaction—device, location, time, purchase history, and transaction value—systems can apply appropriate security levels. A customer making a typical purchase from a recognized device might face minimal friction, while unusual transactions trigger additional verification steps.

Progressive Security Layers

Security measures should escalate proportionally to risk signals. Low-risk transactions can proceed with minimal verification, while higher-risk scenarios trigger additional security layers without blocking legitimate transactions outright.

Transparent Communication

When additional verification is necessary, clear communication about why these steps are required helps maintain customer trust. Educating users about how security measures protect them transforms potential friction points into reassurance of protection.

Balancing Regulatory Compliance and User Experience

Payment providers must navigate increasingly complex regulatory requirements while maintaining a positive customer experience:

Strong Customer Authentication (SCA)

Regulations like the EU's PSD2 mandate multi-factor authentication for many online transactions. Smart exemption management and transaction risk analysis allow providers to apply SCA only when necessary, reducing friction for low-risk transactions.

Know Your Customer (KYC) and Anti-Money Laundering (AML)

These critical compliance requirements can be implemented with varying levels of friction depending on risk profiles. Advanced document verification technologies can now verify identity documents in seconds rather than days, dramatically improving the onboarding experience while satisfying regulatory requirements.

Best Practices for Optimizing the Balance

Organizations seeking to master the balance between security and user experience should consider these approaches:

Data-Driven Decision Making

Analyze transaction data, abandonment rates, and fraud patterns to find the optimal security threshold for your specific business. A/B testing different security approaches can reveal which methods provide the best balance for your specific customer base.

Customer Segmentation

Different customer segments may have varying tolerance for security measures. Long-term customers with established purchasing patterns might receive different treatment than first-time shoppers.

Cross-Functional Collaboration

Breaking down silos between fraud prevention, customer experience, and product teams ensures a holistic approach to the challenge. When these teams collaborate, security measures can be designed with user experience in mind from the outset.

The Future of Frictionless Security

The coming years will bring new innovations that further reduce the tension between security and user experience:

Decentralized Identity

Blockchain-based identity solutions may eventually allow consumers to control their own identity verification, streamlining authentication across multiple services while maintaining security.

Ambient Authentication

Advanced analytics and IoT integration may enable continuous background authentication that requires virtually no conscious user action. By combining multiple passive signals—from device

characteristics to behavioral patterns—systems can maintain high security without active user participation.

Conclusion

The friction dilemma in digital payments isn't going away, but it is evolving. The most successful organizations will be those that view security and user experience not as competing priorities but as complementary elements of a trusted payment ecosystem. By implementing intelligent, risk-based approaches that apply the right level of security at the right moment, payment providers can deliver the seamless experiences customers demand while maintaining robust protection against increasingly sophisticated fraud. The future belongs to those who can transform necessary security measures from obstacles into reassurance—delivering protection that customers value rather than friction they resent.

About Amazon

Amazon.com is guided by four principles: customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking.