No touch, no trouble? Rethinking fraud in a world of invisible payments

Payments have grown quieter, happening in the background of shopping experiences. The checkout process is more automated, requiring little to no customer intervention.

Corporate giants have taken note. Mastercard announced in November 2024 that it aimed to transform e-commerce with numberless cards by 2030. Amazon’s Just Walk Out technology allows customers to simply exit a store to initiate a payment rather than visiting a cashier or self-checkout kiosk.

Invisible payments are quickly becoming the new norm, and merchants must adapt accordingly.

The invisible payment takeover

Customers barely need to think about making payments these days.

Amazon was one of the first to jump on the trend of cashierless and checkout-free shops, developing its Just Walk Out technology in 2018. Despite challenges Amazon faced (such as high operational costs and low customer adoption), other businesses have taken the concept and improved upon it.

In 2021, Tesco opened its first checkout-free store. Located in central London, the shop was strategically placed to target city-based consumers, a demographic more likely to take interest in a checkout-free experience. Using the Tesco.com app, customers can check in to the store when they arrive, pick up the groceries they need, and walk out of the store when they’re done shopping.

It’s not just grocery and retail stores adopting this kind of technology, either. Gas stations have started accepting tap-to-pay, giving customers a single payment touchpoint and the option to go card-free if they prefer using a mobile wallet. Car manufacturers are also introducing in-car payments, such as Mercedes Pay, which lets customers pay for parking, fueling, and more directly from their vehicles.

Meanwhile, EV charging stations are taking invisible payments even further. The European charging provider IONITY developed Plug & Charge technology that allows customers to plug into the charging station and pay automatically once connected.

No matter where you look, you can find invisible payments growing deeper and deeper roots.

Positive customer experiences drive the growth of invisible payments

A poor customer experience can deter up to 43% of customers from returning to your business, per payabl.’s The state of European checkouts report.

Invisible payments eliminate friction and increase convenience to such a degree that customers barely even notice the payment taking place.

Recurring payments can be set up to make automatic charges on a regular basis without needing additional approval beyond the initial authorisation. Things like streaming subscriptions and delivery services can now save customer payment information and enable one-click payments, or not require customers to initiate a payment or interact with a checkout interface at all.

One-click payments have witnessed a particular spike in popularity due to major e-commerce players, like Amazon, adopting the technology. A growing preference for one-click payment options coincides with an increasing demand for instant payments, a market set to exceed 21 billion transactions by 2028.

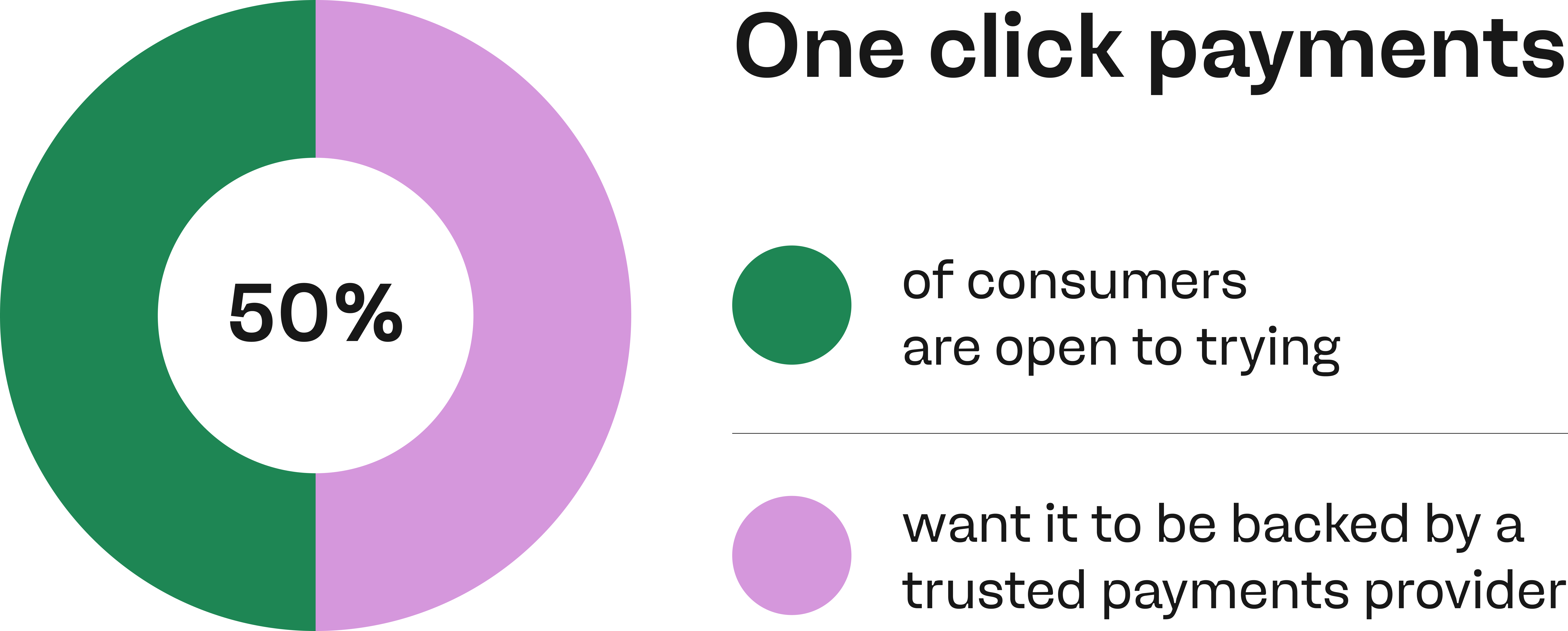

According to payabl.’s research on European checkout preferences, however, one-click payments present both an opportunity and a challenge. Nearly 50% of consumers are open to trying them, but concerns remain around trust and security. Half would prefer one-click payments to be backed by a trusted payment provider, such as Visa or Mastercard.

These recognisable payment brands play a crucial role in boosting consumer confidence, reinforcing the importance of working with established players to build trust.

The invisible payments trend extends beyond just big-name corporations, however. Even in local and regional settings, we are seeing a shift to seamless and unseen payment experiences.

Optimising payment flows with lower touchpoints

Payment flows built to be discreet offer significant operational benefits beyond customer satisfaction alone. Reducing the number of steps in the payment journey minimises friction and can reduce drop-off caused by customers either forgetting to make a payment or becoming frustrated with the process.

Fewer touchpoints translate to both enhanced convenience and stronger security.

To make payments happen without the need for manual authorisation or information entry every time, a payment system must have the proper tools for validating a customer’s identity.

Goodbye cards, hello tokens

Are plastic cards on the way out? Technologies like tokenization and biometric authentication can quickly verify a customer is who they say they are, keeping payments flowing smoothly and out of sight. These technologies can also improve authorisation rates and reduce false declines by tying a customer to a specific and unique metric, such as a token or a fingerprint, making them far more difficult to impersonate.

Tokens specifically give customers the freedom to go about their day without needing to carry a physical card with them at all. As long as they have a device that can access a mobile wallet, they can shop at stores that have adopted tokens into their payment strategies.

Soon, we may see a future where cards are irrelevant to payments, spearheaded by major card networks like Mastercard who are aiming to achieve total e-commerce tokenization by 2030.

Fraud challenges in invisible payments

Though the lack of visible authentication steps can offer greater convenience, it can also create new vulnerabilities and shift fraud attack vectors to tactics like account takeover or synthetic identity fraud. The very capabilities that make invisible payments so enticing, such as reduced user interactions, can also make these transactions more susceptible to savvy attackers.

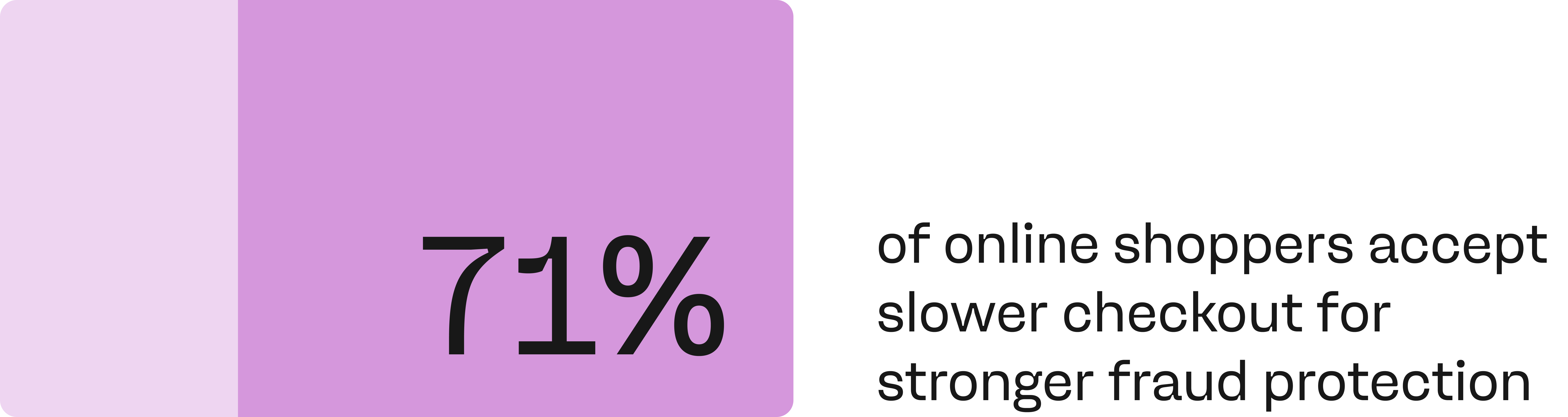

Sometimes, customers are even willing to sacrifice payment speed in exchange for security. payabl. research shows that 71% of online shoppers will accept a slightly slower checkout experience if it means that stronger fraud protection measures are in place.

Account takeover (ATO), for example, can slide under the radar of a fraud detection system when transactions are processed automatically with minimal user interaction or visible checks. Proofpoint data shows that 99% of organisations Proofpoint monitors were targeted for ATOs, and 62% experienced at least one successful account takeover (though the average was 12 per organisation).

Looking at some of the real-world examples discussed earlier, even touchless and biometric-based payments can become prey for fraud without proper diligence.

The Economic Times reports that scammers in Europe are using hidden contactless card readers to defraud unsuspecting victims by simply walking by them. At the same time, AI has grown more sophisticated and can now enable bad actors to use the technology to bypass biometric banking security measures, according to Forbes.

As for cashierless and checkout-free stores, more than a few kinks still need to be smoothed. One challenge that Amazon and other companies have encountered is how to verify that a customer left with items that cannot be chipped, such as fresh produce. Other shops are working to prevent theft through amped up surveillance, toeing the line between security and an invasion of shopper privacy.

As fraud attack vectors evolve, merchants and payment service providers (PSPs) are turning to equally invisible defences. Smart authentication techniques are being deployed behind the scenes to verify users without disrupting the payment flow, guided by regulations like PSD2 and 3DS.

Fraud remains an ever-present problem in the payments space, requiring merchants to adjust their approach regularly. Invisible payments should be reinforced with automated fraud detection and prevention tools that can evaluate multiple data points simultaneously and identify suspicious activity that may otherwise go unnoticed. These technologies allow businesses to strike the right balance between security and user experience, protecting both their operations and their customers.

Striking the balance of security and user experience

Invisible payments require equally invisible vigilance.

Merchants cannot afford to ignore the threat of fraud, especially as we move into an era where AI is making it easier than ever to impersonate others. Connecting your business technologies while maintaining an effective fraud prevention program requires strategic partnerships.

Tailored financial solutions can be the key to building intuitive checkout interfaces that please customers alongside precisely developed backend solutions for payment processing and fraud prevention. A successful malicious attack puts everyone in your company ecosystem at risk, reiterating the need to work with providers can help you better manage your fraud risk levels with in-depth dashboards and other visualisation tools.

Taking a proactive approach means going above and beyond with investments in intelligent tech that can automatically monitor and validate payments as needed.

We’re witnessing a shift in how merchants and the payments industry as a whole think about authentication. It’s all about removing touchpoints where possible while weaving security features tightly into the background so that they feel nonexistent to the user, but powerful in the face of fraud.

Over the coming years, we’re sure to see companies differentiate themselves according to their ability to ciphen out fraudulent transactions from real ones. Taking action now to prepare your payments strategy to address evolving fraud threats will prepare your business for tomorrow.

About payabl.

payabl. powers merchant growth by simplifying payments and payment security. Offering a variety of payment products for both online and in-person transactions, the company helps merchants build omnichannel payment experiences and improve overall transaction transparency. The core mission driving payabl. is to be the financial services partner of choice in the EU and UK.

Learn more about payabl. solutions at payabl.com.