Building a Resilient Checkout for 2026 and Beyond

Black Friday and Cyber Monday (BFCM) push ecommerce systems to their limits. It’s the time when checkout performance, fraud controls and payment reliability are tested at scale. For merchants, the ability to offer a resilient checkout experience can determine whether they capture or lose peak-season revenue.

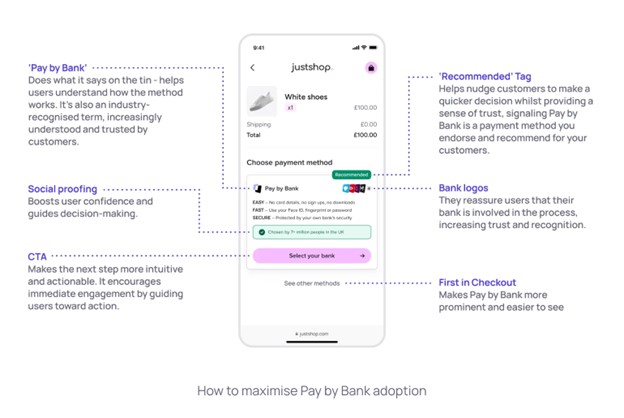

Resilience today goes beyond uptime. It means building a secure online checkout that maintains performance under pressure, prevents fraud, and enables customers to pay quickly and confidently. This article looks at how Pay by Bank strengthens checkout resilience and what to consider when assessing your own payment setup.

1. Frictionless by Design: Reducing Abandonment and Risk

A high-conversion checkout strategy starts with removing unnecessary friction. Slow or complex checkout flows drive cart abandonment and increase the likelihood of fraud attempts.

Leading merchants are reducing risk and improving performance by:

- Minimising manual data entry

- Reducing steps to payment confirmation

- Creating mobile-first checkout designs

The most effective checkouts today are designed to be frictionless payment solutions, enabling customers to complete purchases in seconds, without compromising on security. Pay by Bank is a strong example of this approach. It allows customers to authenticate directly through their trusted banking app, removing the need to enter card details or passwords.

This creates a faster, simpler and more secure flow, especially on mobile, where most ecommerce transactions now take place. With fewer steps and no sensitive card data to store, merchants can reduce both drop-off and fraud exposure.

2. Scalable Checkout Systems for Peak Traffic

During BFCM, checkout systems must handle unpredictable surges in demand. A scalable checkout system is one that can maintain speed and reliability even under heavy load.

Pay by Bank operates on real-time bank rails that can handle high transaction volumes without relying on card networks, which often become congested during major retail events. By diversifying payment options and removing single points of failure, merchants improve both resilience and risk control.

When choosing a Pay by Bank provider, here are some factors worth checking:

- Network size: A large, active user base signals consumer trust and familiarity. That recognition often translates into smoother experiences and higher checkout conversion.

- Capacity for peak volumes: Ask about metrics such as annualised payment volume or records for transactions per second/minute. These give a clear sense of whether the provider can handle thousands of concurrent payments without degradation in speed or reliability.

- Enterprise-grade infrastructure: Look for evidence the provider has proven performance with high-traffic businesses. Integrations with major PSPs, partnerships with large merchants, and uptime statistics of 99.9% or higher are strong indicators of resilience.

3. Payment Failure Recovery and Orchestration

Payment declines are a persistent issue during busy periods. Many result from expired cards, insufficient funds or blocked transactions — all common with card-based payments. Pay by Bank helps merchants avoid these pitfalls entirely, since funds are transferred directly from a customer’s bank account, with instant confirmation.

A resilient checkout:

- Reduces decline rates (especially for legitimate transactions)

- Avoids unnecessary 3DS interruptions

- Bypasses expired, blocked, or insufficient funds issues that often plague cards

4. Security and Trust as Conversion Drivers

Security and conversion are often treated as separate priorities, but they should be part of the same design principle. A secure online checkout should make customers feel safe without slowing them down.

A resilient checkout:

- Remains secure without adding unnecessary steps to the payment flow. This helps businesses like Jaja Finance see 71% of their customers choosing Pay by Bank and citing 8 out of 10 or higher customer satisfaction with Pay by Bank.

- Meets regulatory standards like PSD2 and SCA, without adding friction.

- Displays visible trust cues and transparent communication about authentication steps

Pay by Bank strengthens security through bank-level authentication. Because customers authenticate within their own banking app, merchants can remove sensitive data handling from their checkout entirely. This dramatically reduces fraud risk, simplifies compliance with Strong Customer Authentication (SCA), and builds trust through familiar, verified interfaces.

The most resilient checkouts are also the most trusted. Customers who feel secure are more likely to complete a transaction and return in future.

5. Preparing for the Future of Ecommerce Checkout

The future of ecommerce checkout will be defined by technologies that combine performance, security and simplicity. As we move toward 2026, merchants are increasingly turning to next-generation payment infrastructure that can adapt dynamically to device, context and risk level.

Pay by Bank sits at the centre of this evolution. It represents an adaptive checkout technology designed for the real-time economy: fast, secure, and built on open banking APIs that provide direct, regulated connections between banks and merchants.

By adopting frictionless payment solutions like Pay by Bank, merchants can improve ecommerce checkout resilience, reduce fraud exposure and provide a better customer experience across all devices.

About TrueLayer

At TrueLayer, we partner with merchants to help them build these fraud-proof checkout solutions through open banking technology. By combining scalability, security and simplicity, merchants can prepare their checkout not just for the next Black Friday, but for the future of ecommerce checkout itself.

TrueLayer is Europe’s fastest growing payments network. We power smarter, safer and faster online payments by combining real-time bank payments with financial and identity data. Businesses use our products to onboard new users, accept money and make payouts in seconds, and at scale. We’re on a mission to change the way the world pays and won’t stop until we’ve unlocked the full potential of payments.