Scaling Payments for Infra providers, SaaS platforms & Fintechs

Infrastructure providers, SaaS platforms, and Fintech enterprises (ISFs) are the engines powering modern digital commerce. They grow their business by expanding the base of clients served, yet this growth introduces a distinct friction point: payments. As these platforms scale, they face increasing pressure to support clients who bring their own payment processors, require diverse payment methods, demand advanced flows, or operate under complex operational models.

For engineering teams at these enterprises, this creates a significant burden. They are often forced to spend years building and re-engineering proprietary implementations to manage multiple PSP integrations, handle client-level isolation, enable secure onboarding, and support rich payment flows across various industries.

This blog explores the common challenges faced by SaaS, Platforms, and Fintech enterprises and how a modular, open-source payment orchestration platform simplifies these complexities. We will analyze the four major challenges hindering scale and discuss the architectural approach required to address them.

Challenge 1: Diversity

The most immediate hurdle for any growing platform is the sheer diversity of the payments ecosystem. Enterprise clients demand flexibility, often mandating connections to local acquirers, specific fraud engines, or legacy banking rails. This diversity creates complexity across four major tangents:

1.1 Connectors

A connector is an element of the payment ecosystem that plays a part in the transaction flow. This includes Payment Service Providers (PSPs), Payment Platforms or connect accounts, Fraud Risk Management (FRM) engines, Payout providers, 3DS servers, Vaults, Tax calculation engines, and Subscription engines.

Perhaps the most technically frustrating aspect of diversity is the lack of standardization. Every PSP speaks a different language. The challenge lies in trying to unify these flows and in maintenance. Integrating a connector is not a one-time event; it requires constant updates to support new payment methods and flows. ISFs typically struggle to offer a wide range of pre-existing PSP and connector options right out of the box to enable swifter onboarding for their clients. They need the ability to integrate regular PSPs, Platform/Connect accounts as well as payment enablers like 3DS, Vault, Subscription, and Fraud engines seamlessly.

1.2 Payment Methods

Consumer preferences are shifting rapidly. While cards remain dominant, the rise of Alternative Payment Methods (APMs) is undeniable. Platforms must support global wallets like Apple Pay, Google Pay, Amazon Pay, and Samsung Pay, alongside region-specific giants like SEPA, iDEAL, and hundreds of others.

1.3 Payment Flows

The unified API needs to be robust to meet the requirements of different industries in terms of payment flows, including:

- CIT (Customer Initiated Transaction): Standard immediate purchases.

- Relay of External Transactions: Handling refunds or captures for transactions authorized outside the system.

- MIT (Merchant Initiated Transaction): Recurring payments using PSP tokens or Network Tokens.

- $0 Auth: Verification payments to validate card details without charging.

- Manual Capture: Authorizing now and capturing later (often in multiple partial captures).

The Solution: A Robust and Reliable Payments Platform

To solve diversity, ISFs need a platform that acts as a reliable and robust translator and abstraction layer.

- Mature Platform with High Reliability: A mature system would have seen wide diversity, considered solutioning alternatives and built the right abstractions. The product robustness and IP will allow the platform to accommodate new integrations, payment methods or flow enhancements in a matter of days. A stable platform also allows use of frameworks and LLMs to deliver enhancements or new integrations quickly and with high confidence.

- Deep Integrations: The platform must support rich parameters, including L2/L3 data, raw connector responses, and order data, ensuring that complex flows (like partial captures or split settlements) are supported natively.

- Error Normalization: A robust orchestration layer standardizes error codes and messages across PSPs. For example, it can map “PSP 1 – 101” and “PSP 2 – 1314” to a single normalized code such as “US_1000 – Issue with payment method,” or normalize errors originating from underlying entities like issuers or networks. This enables ISFs to implement consistent, standardized handling logic while still retaining access to raw PSP responses for deeper debugging and analysis.

Challenge 2: Onboarding & Configurations

As an ISF, you are not just processing payments; you are managing a hierarchy of clients, each with their own distinct needs. The operational overhead of onboarding new merchants and configuring their specific stacks can become a bottleneck to growth. This challenge breaks down into three primary tangents:

2.1 Programmatic Onboarding

ISFs typically operate in one of two modes: acting as the Merchant of Record (MoR) or allowing the client to be the MoR. In both cases, manual onboarding is unscalable. It will lead to slow activation, drop-offs and may introduce compliance risk. ISFs need to:

- Create and isolate merchant entities programmatically

- Assign roles and permissions using RBAC (Role-Based Access Control)

- Provision API keys and environment access automatically

- Maintain audit logs for regulatory review

Without automation, onboarding becomes the bottleneck that limits how quickly the platform can scale into new markets or support new merchant cohorts.

2.2 Complex ConfigurationsEvery client arrives with a unique stack. One merchant may bring their own Adyen credentials, while another uses the Platform’s Stripe Connect account. Many operate across multiple countries, each with different payment methods, authorization rules, and regulatory obligations. ISFs must manage configurations like:

- Enabling PSPs per merchant, market, or transaction type

- Managing multiple MIDs or accounts for the same PSP

- Customizing themes, payment pages, and UX flows

- Controlling how customer data (tokens, vault entries) can be shared

- Handling region-specific requirements (SCA, local rails, payout rules)

More often than not, ISFs are probably having configuration drift and an unstandardized way of building components that can feel like duct tape half the time. A robust platform needs structured, versioned, and auditable layers in order to have a reliable platform at scale.

2.3 Workflow Orchestration

Platforms need dynamic workflows to optimize success rates and costs. This includes:

- Routing

- Rule-based routing: Configuring deterministic logic based on the merchant’s requirements or payment metadata.

- Intelligent Routing: Dynamically selecting the optimal PSP based on auth rates or cost.

- Smart Retries: Automatically retrying failed retriable transactions via secondary routes.

- Conditional Logic: Applying 3DS, Vaulting, or Surcharge rules based on the transaction context.

The Solution: A multi-hierarchy payments platform with deep workflows

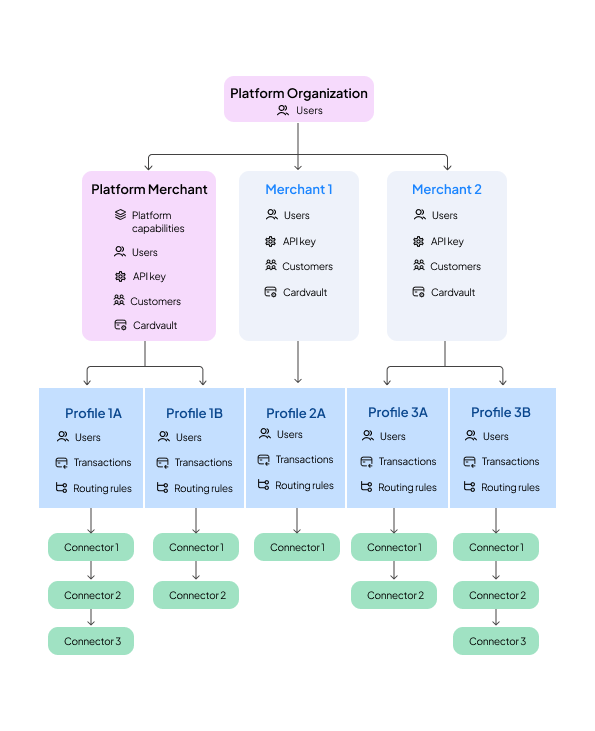

A modular payments platform addresses this through a strict, multi-level hierarchy designed for platforms.

- Organization-Merchant-Profile Structure: This 1:many:many relationship ensures true data isolation while allowing the Organization to manage global settings.

- Organization: The ISF oversees everything and can programmatically create and configure merchants and profiles.

- Merchant: The logical isolation offered to the client.

- Profile: The "leaf nodes" where specific PSPs, payment methods, and workflows are configured.

- Embedded Onboarding: The platform should offer embedded dashboard components for PSP configuration, Workflow creation and more . This allows ISFs to let their clients securely enter PSP API keys directly on the ISF’s own dashboard, without the ISF ever having to store sensitive credentials raw.

- Granular Access Control: By defining user roles at the Organization, Merchant, and Profile levels, ISFs can delegate control where appropriate while maintaining high-level oversight.

Challenge 3: Observability and Monitoring

ISFs face challenges in delivering on Service Level Agreements (SLAs) because the payment data is often siloed within external vendor dashboards. Delays in diagnosing issues literally translates directly to revenue loss, higher support burden, and reduced merchant trust. In order to deliver a reliable payments solution at scale, observability spans four critical tangents:

3.1 Unified Visibility

ISFs need to see the full picture in one unified dashboard. It can't be piecemeal snapshots scattered around different PSP dashboards. They must be able to view high-level metrics (Global Transactions, Success Rates) and drill down into granular details at the Merchant and Profile levels by dissecting this number across multiple parameters such as PSP, payment method, currency, card network and many more.

3.2 Fast, Independent DebuggingWhen a transaction fails, the clock starts. Relying on external sources or platforms alone creates delays that break SLAs. ISFs require a centralized audit trail that logs every request, response, and state change in the payment lifecycle. This would empower support teams to handle the first response by performing the first-level of debugging independently in all cases for all their merchants.

3.3 Custom, Proactive Alerting

Reactive monitoring is insufficient. Operations teams need proactive alerts related to:

- Infrastructure: System health, latency spikes, degraded services and more

- Applications: Connector errors, retry failures, API errors like timeouts and more

- Business: Sudden drops in authorization rates, spikes in declines for a payment method and more

3.4 Merchant Service Levels Expectations

ISFs often guarantee SLAs with their clients regarding response and resolution times. To meet these, they cannot be dependent entirely on external vendor support. They need self-serve capabilities to diagnose issues immediately, real-time metrics, instant alerting and internal audit logs.

The Solution: Unified Observability

The payments kernel must serve as the single source of truth.

- Detailed Transaction Logs: The platform should offer an entire audit trail on the dashboard. This allows ISFs to perform first-level debugging themselves without external dependencies.

- Developer Observability: Engineering teams need to have access to metrics like connector performance, infrastructure health, routing decisions, latency metrics and more.

- Multi Sub-Merchant Alerting: A sophisticated alerting system can detect PSP downtimes or error rate increases across specific merchants. This enables the ISF to proactively notify their clients (sub-merchants) and suggest fallbacks, effectively turning a technical outage into a managed touchpoint.

Challenge 4: Control & Ownership

The final, and perhaps most strategic, challenge is the tension between buying a solution and building it in-house. ISFs have traditionally built key features in-house because payments are core to their business. They often have valid apprehensions:

- Vendor Lock-in: Depending on a vendor without knowing their technical capabilities

- Loss of IP: Not owning the capabilities that differentiate their product.

- Disruptive Migrations: Not having a simple path to augment their current stack without a "rip and replace" migration.

To move fast and maintain long-term control, ISFs need a model that allows them to extend, not replace.

4.1 Extensibility without Rewrites

Most platforms force you into predefined flows. ISFs, however, need interoperability: the ability to add or swap capabilities without breaking existing systems. Examples include

- Adding their preferred fraud provider, the existing vault or tokenization service

- Plugging in a cost observability, intelligent routing or connector extension module

- Triggering incremental payment actions (e.g., an OMS initiating capture or refund) even if the platform did not perform the original authorization

4.2 Ownership with Optionality

Enterprises don’t want to choose between the agility and convenience of SaaS convenience and control and ownership of self-hosting. They need:

- SaaS for a faster Go-To-Market (GTM)

- Self-hosting for long term ownership and control governance, localization requirements or data residency

- Clear path to transition without breaking APIs or rewriting checkout flows

The Solution: Composable Architecture

A composable payments architecture eliminates vendor lock-in by allowing ISFs to extend, replace, or fully own individual components of the payments stack.

- Modularity: ISFs should be able to leverage point solutions, like Intelligent Routing, Connector Services, Vaults, or Revenue Recovery to augment or extend their existing capabilities.

- Relay Suites: For platforms that sit differently in the commerce flow (e.g., a Warehouse Management System triggering a refund), the platform should offer "Relay APIs." This allows the ISF to make direct requests to PSPs to perform operations (like Refund or Capture) on an existing resource, even if the original transaction was captured outside the system.

- Flexible Deployment: The ideal architecture offers:

- Enterprise Edition: Full in-house control, data residency, and compliance ownership.

- Cloud Edition: For those looking for a fully supported SaaS offering with zero operational overhead.

- Hybrid: Offload PCI-sensitive components (like a hosted Vault) while keeping business logic, routing, and data workflows entirely in-house.

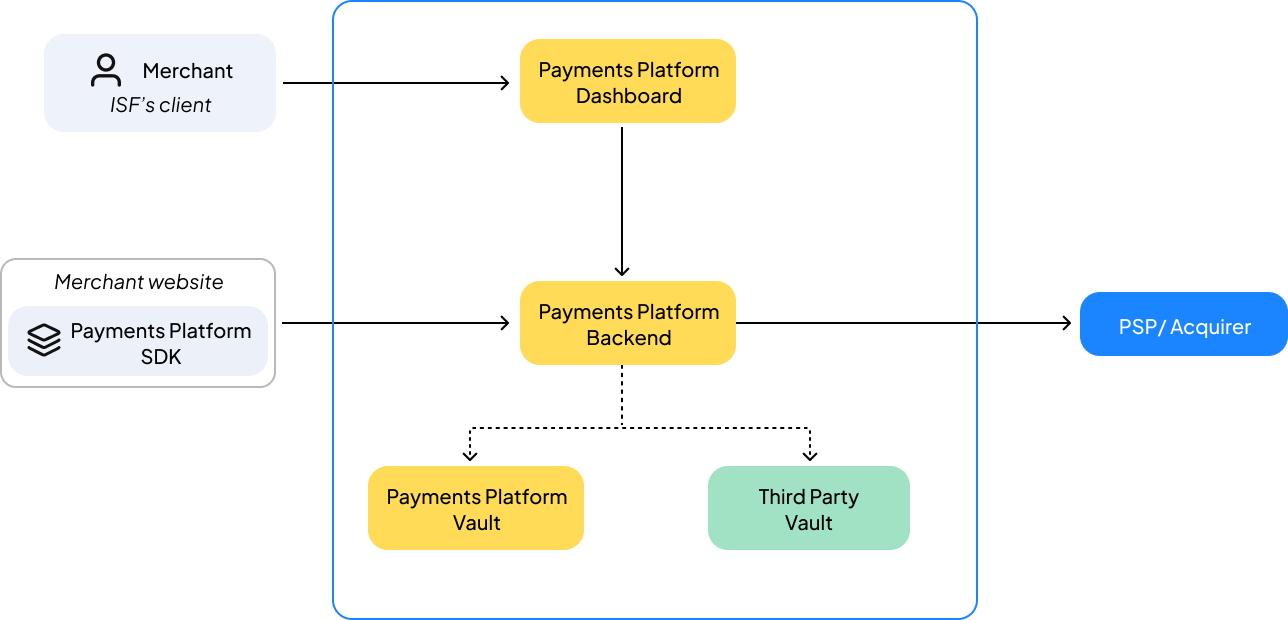

1. Full stack payment product integration - For end-to-end modernization for SDK, Dashboard, Vault, Core workflows, and Connector extensions with the payments platform

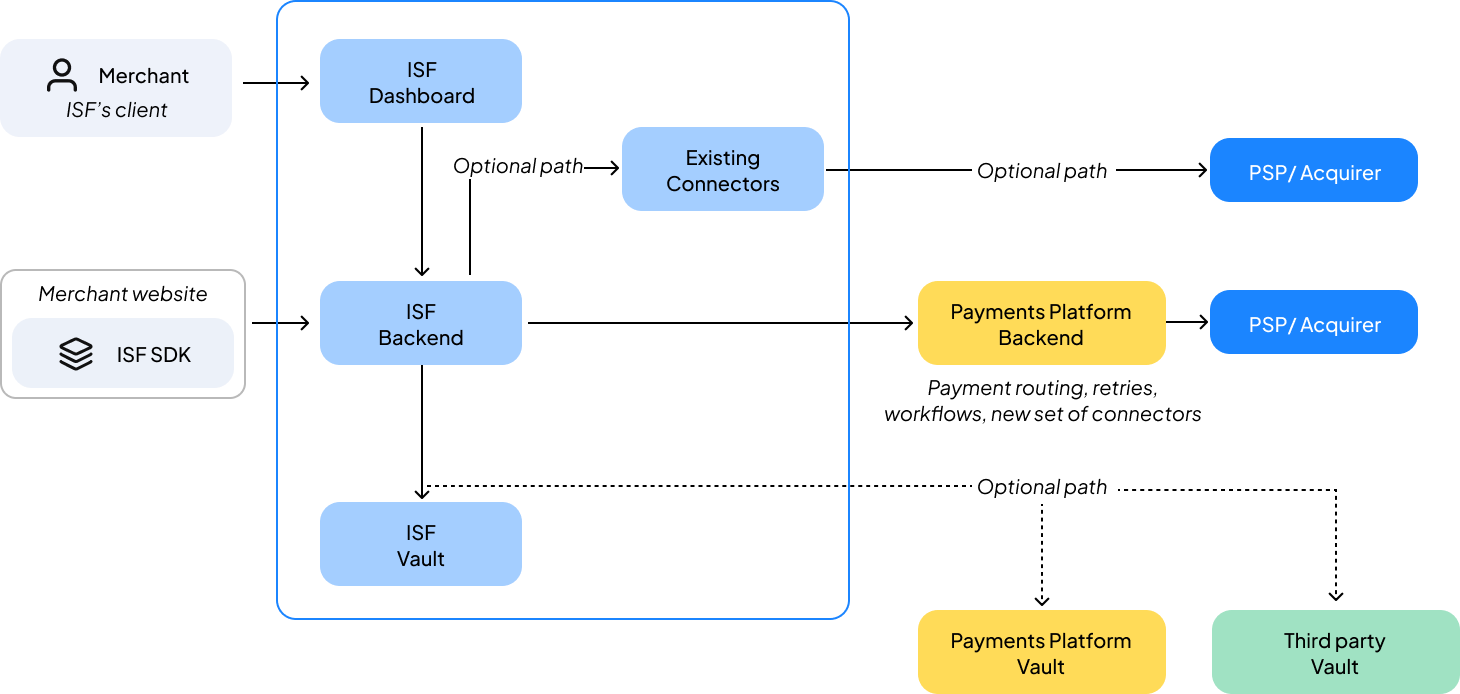

2. Backend-only payment product integration (optionally with 3rd party Vault + SDK) - For retaining control on SDK, Dashboard, and Vault (optional) while Core workflows and connector extensions are offered by the payments platform

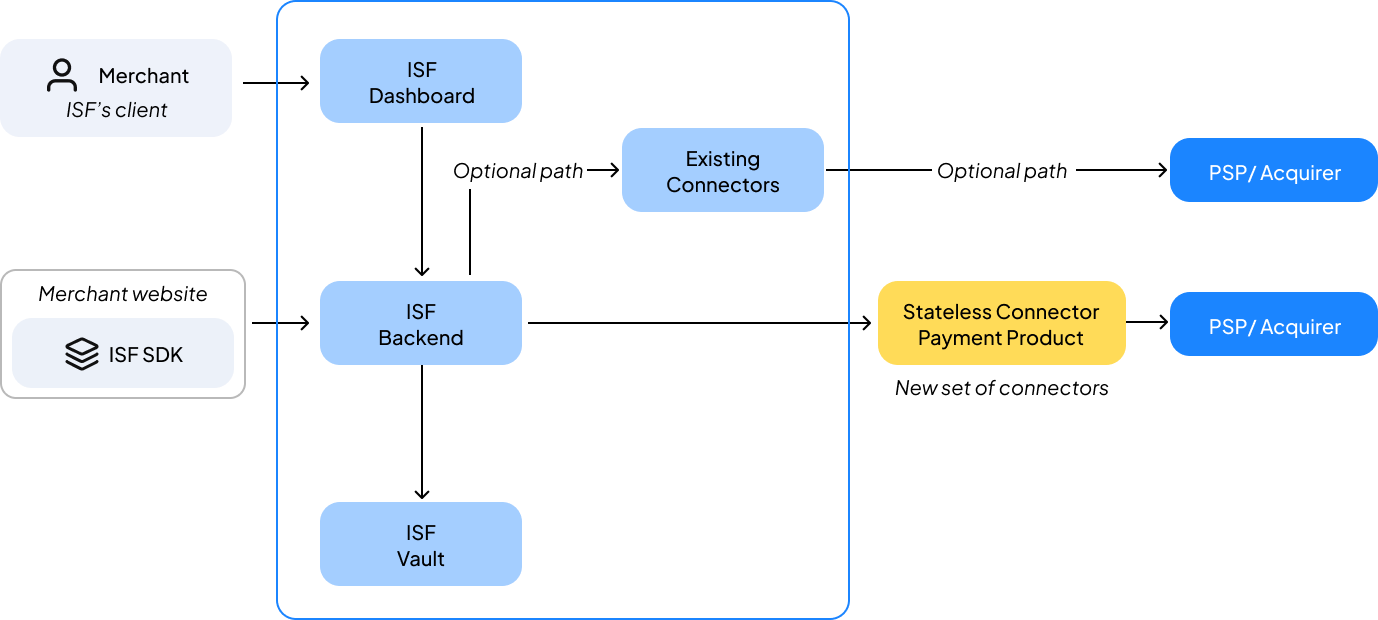

3. Stateless connect payment product integration - For retaining control on SDK, Dashboard,, Vault, and Core workflows while connector extensions are offered by the payments platform

Breakdown Payment Barriers

For Infrastructure providers, SaaS, and Fintechs, payments are no longer just a utility, they are a competitive advantage. The complexity of managing diversity, onboarding, observability, and control can stifle growth if handled with monolithic or purely proprietary approaches.By adopting a modular, open-source approach, ISFs can break down these barriers. They can offer their clients the diversity of the global ecosystem, streamline operations through programmatic hierarchies, and gain deep visibility into every transaction. Most importantly, they can do this while retaining control over their roadmap, ensuring that their payment stack evolves as fast as their business does.

For more on this topic, MRC members may watch the webinar, Scaling Payments for SaaS, Platforms and Fintechs - Presented by Juspay, in the MRC Resource Center.

About Juspay

Juspay is a trusted payments leader processing billions of transactions annually for major global brands. Contact us to explore Hyperswitch, our open-source repository - a transparent, customizable orchestration layer built for scale - or to get started with our hosted platform today!