Understanding Visa’s VAMP Program: Key Takeaways from the MRC Webinar

As fraud tactics evolve and disputes grow more complex, the payments industry is being pushed to adapt. In April, Visa introduced the Visa Acquirer Monitoring Program (VAMP)— consolidating several legacy monitoring systems into a single risk-based framework.

Ahead of the rollout, MRC members voiced significant concerns about certain elements of the program—especially the inclusion of TC40 records from resolved disputes and the steep acquirer portfolio thresholds. In response, the MRC gathered and delivered direct feedback from merchants, issuers, acquirers, and solution providers to Visa. As a result of these discussions, Visa announced the extension of the advisory period to 1 October 2025, giving stakeholders more time to prepare.

Building on that dialogue, the MRC recently hosted a webinar with Visa, giving merchants, acquirers, and risk professionals an in-depth look at what’s changing, why it matters, and how to navigate the changes. Below is a recap of the key takeaways.

What is VAMP?

VAMP consolidates five legacy programs—including the Visa Fraud Monitoring Program (VFMP) and the Visa Dispute Monitoring Program (VDMP)—into one simplified framework.

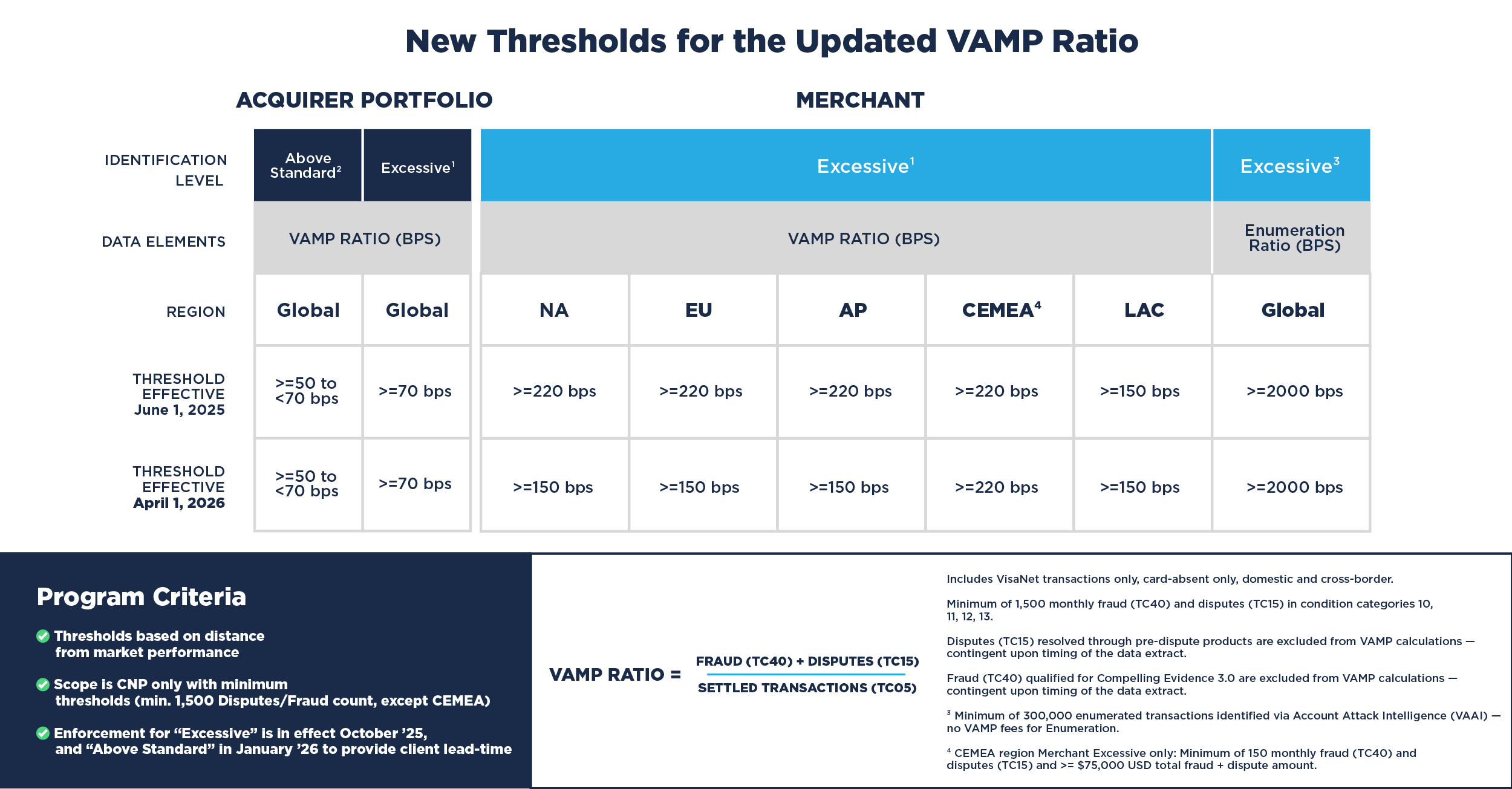

Instead of managing multiple separate metrics and thresholds, Visa is introducing a single "VAMP Ratio", which calculates:

(Total Fraud Transactions (TC40) + Non-Fraud Disputes (TC15) / Total Settled CNP Transactions).

According to Visa, the inclusion of both TC40 and TC15 data is intended to provide a more complete picture of consumer friction—even when disputes are resolved without a chargeback.

During the webinar, Visa outlined VAMP’s four primary objectives:

- Reducing Consumer Friction

VAMP places more focus on transaction-level monitoring, rather than only looking at large-scale fraud. This shift is meant to address pain points that occur even in small, routine purchases—where a single failed or disputed payment can affect consumer trust and long-term behavior. - Streamlining Operational Delivery

The program reduces the number of merchant identifications and simplifies the remediation process. This change is intended to lower the operational burden for both acquirers and merchants, who previously had to manage overlapping or redundant compliance workflows. - Allowing Flexibility for Evolving Business Models

With new types of merchants entering the ecosystem—like app-based platforms, digital goods sellers, and marketplaces—Visa built VAMP to accommodate a range of risk profiles within acquirer portfolios, without applying one-size-fits-all penalties. - Improving Fraud Prevention Impact

By consolidating fraud and dispute data into a single monitoring structure, VAMP aims to detect problematic trends earlier and resolve them before they escalate into broader issues.

VAMP Rollout Timeline

Visa is rolling out VAMP in phases to give acquirers and merchants time to adjust to the new metrics and processes:

| Phase | Dates | Details |

|---|---|---|

| Advisory Period | 1 April – 30 Sept 2025 | No penalties; metrics shared for awareness and preparation |

| Initial Enforcement | 1 Oct – 31 Dec 2025 | “Excessive” tier penalties begin for merchants and acquirers |

| Full Enforcement | Starting 1 Jan 2026 | “Above Standard” tier introduced for acquirers; thresholds tighten |

Thresholds vary by region and role and are based on VAMP Ratio performance (fraud + dispute counts over CNP transactions).

Penalties & Fees

Merchants and acquirers who exceed these thresholds face financial penalties starting in October 2025, with increasing severity for repeated violations:

- “Above Standard” status: $5 per flagged transaction

- “Excessive” status: $10 per flagged transaction

- A 3-month grace period applies to first-time offenders during a rolling 12-month window.

What Should You Do Now?

Preparation is key. Here’s how merchants and acquirers can get ready during the advisory period:

- Monitor your VAMP Ratio: Use Visa dashboards or third-party tools, and work with your acquirer to understand how your metrics compare to program thresholds.

- Strengthen fraud defenses: Block bots, detect enumeration attacks, and improve CVV/AVS checks.

- Enhance dispute management: Leverage Order Insight, CE 3.0, and refund flows to avoid preventable chargebacks.

- Collaborate with acquirers: Align on metrics and action plans for merchants nearing thresholds.

Final Thoughts

The VAMP framework represents a significant change in how fraud and dispute monitoring will be handled across the ecosystem, bringing both structural and operational impacts for merchants and acquirers.

One notable shift is the increased transparency: for the first time, Visa is making merchant-level data available during the monitoring process—something made possible through ongoing collaboration with the MRC and the collective feedback from the merchant community.

This visibility allows merchants to assess their performance more clearly and take action before enforcement begins. As VAMP moves through its advisory phase, the MRC will continue to encourage feedback, share educational content, and support members in preparing for the full rollout. If you haven’t already, connect with your acquirer, review Visa’s published resources, and assess your current risk posture—well before the thresholds tighten and penalties take effect.