Credit Card Payments: Here Are the Top 5 Things Merchants Need to Know

Member News

Blog

Alternative Payments

Trustly

Jul 13, 2020

Blog

Whether shopping online or picking up food from your favorite restaurant, credit cards have become ubiquitous for payments. Merchants that do not accept credit cards are often at a disadvantage. At the same time, the cost of accepting credit cards is steep and is about to get steeper.

Let's drill down into processing fees and how much merchants end up paying.

Interchange Fees: These fees go to the bank that issues the credit card. For example, if a payment is made with a Visa credit card issued by Wells Fargo, the interchange collected from the merchant is ultimately paid to Wells Fargo. Credit card interchange can range from 1.5% + $0.10 to 3% + $0.10 per transaction depending on the merchant category code, credit card type, and transaction method. These are non-negotiable fees set by the card networks.

Assessment Fees: These fees go to the card network. So in the above example, Visa as the card network will receive the assessment fee. This type of fee ranges from 0.10% to 0.15% and is also a non-negotiable fee set by the card networks.

Processor Markups: These fees vary greatly depending on your payment processor and include the processor's rates, credit card transaction fees, chargeback fees, monthly fees, gateway fees, etc. These markups are typically 12-20% of the total processing costs paid by a merchant.

When a credit card payment is initiated by a consumer on the merchant's site, the merchant's acquiring bank receives the money, deducts the interchange fee for reimbursement to the issuing bank, passes the assessment fee along to the card network, and the processor markups are settled to the processor. The remainder is paid to the merchant.

For example, let's say a consumer purchases a pair of shoes using their Visa Rewards Signature card online for $100. Let's calculate how much the merchant ends up paying towards this purchase of $100. This card has an interchange fee of 2.7% + $0.10 ($2.80), an assessment fee of .15% ($0.15), and processor markups including $0.20 of fixed costs and 0.08% ($0.08) in variable costs. After those fees are divvied up, the merchant is left with $96.77 ($100 - $2.80 - $0.15 - $0.28). That is a whopping 3.23% for the transaction in this example.

A chargeback is a reversal of a transaction that is ordered by the card-issuing bank as a result of potential fraud, a mistaken payment, or a successful consumer dispute. Chargebacks and fraud are amplified with card-not-present (CNP) transactions. Card numbers can be compromised in a number of ways and the potential for friendly fraud is far greater since there are very few ways to provide sufficient proof that a consumer did in fact make the purchase in question. This has forced merchants to implement more controls and inject additional costs in order to accept CNP transactions, leveraging third-party tools for fraud mitigation and chargeback management.

This drives the cost for payment acceptance up and the fraud impact to margins could be as high as 3.75%, even with fraud prevention costs per transaction of $0.50 per transaction. For every 1000 transactions of $100 each, you may end up paying $750 towards chargebacks and fraud prevention costs.

In addition, CNP transaction authorization rates are dramatically lower than card-present transactions. While some declines are addressable by the merchant, there are different factors that can cause a transaction to be declined, creating a poor customer experience and operational challenges in order to optimize authorization rates.

With alternative payment options expanding and growing in popularity, many U.S. merchants are taking a hard look at the costs, risks, and realities of accepting cards.

Where online payments used to be synonymous with credit card payments, P2P payments, alternative financing, and bank transfers are gaining traction. Online banking payments are a compelling alternative to achieve revenue optimization given their lower-than-debit cost and higher approval rate than card-based payments, while also providing a great customer experience.

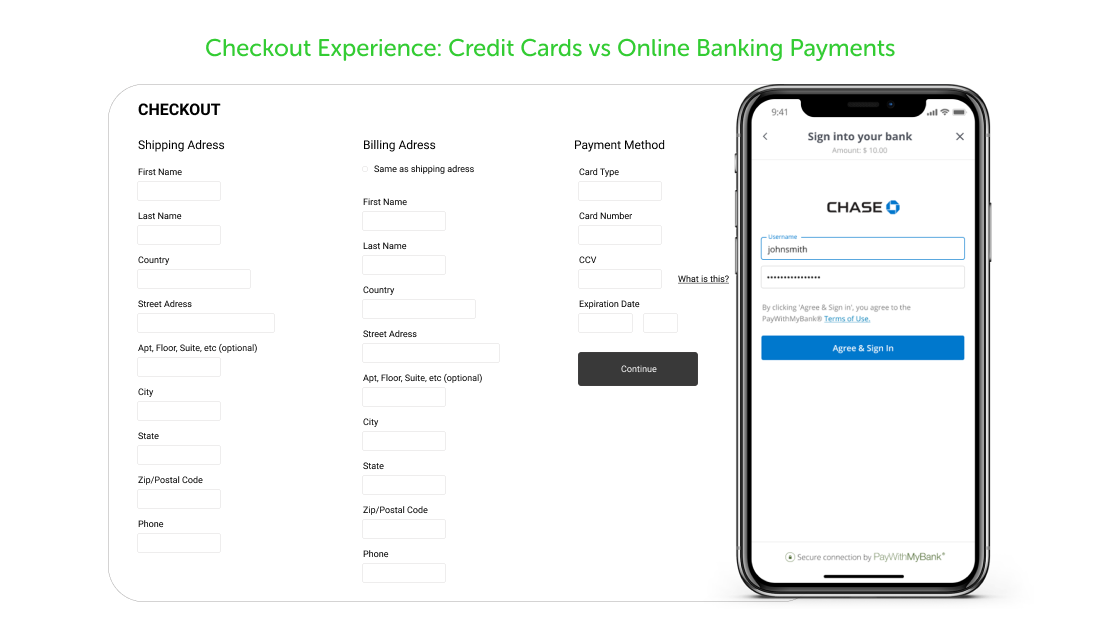

Checkout optimization is critical for merchants. Lengthy forms lead to cart abandonment. According to Barilliance, the three drivers of cart abandonment were unexpected costs, how long it took to check out, and required fields in forms.

The checkout experience: credit cards vs. online banking payments provided by Trustly:

Online banking payments work well for merchants that need to reduce friction and enhance security at the same time. Trustly's PayWithMyBank®️ includes one-click checkout and strong customer authentication (SCA) features, with customers logging into their bank accounts and entering their credentials from memory.

Trustly provides a seamless user experience with intelligent payment technology which lowers payment processing costs and increases transaction approval rates. Merchants and consumers alike can depend on our platform for safe and secure payments.

Trustly's iOS and Android easy-to-deploy software development kits (SDKs) make it the perfect addition to your payment lineup. Due to COVID-19, consumers are increasingly making online and mobile payments, and providing a frictionless payment experience is critical for businesses going forward.

If you want to learn more about how to lower your payment processing costs while increasing your approval rates, take a look at Trustly's whitepaper, How to Lower Your Payment Processing Costs and Increase Approval Rates.

Here are the top five things merchants need to know about credit card payments:

1. The relevance of credit card payments

According to Deloitte Insights, credit card transactions in the U.S. made up nearly $4 trillion in 2018, a sizable chunk of payment volumes. In October 2018, a credit card was used in 23% of all transactions according to the Federal Reserve Bank of San Francisco. Due to COVID-19, eCommerce spending has increased dramatically. Credit card payments, although very prevalent, are facing some headwinds. High processing fees, poor customer conversion, and increasing risks of chargebacks and fraud are the top reasons why merchants are looking for other payment options.Let's drill down into processing fees and how much merchants end up paying.

2. Types of processing fees and how they add up

Credit card processing fees range from 1.5% to 3%+ and can add up very quickly, impacting your profit margins. There are three key elements to understand regarding the fees: interchange fees, assessment fees, and processing markups.Interchange Fees: These fees go to the bank that issues the credit card. For example, if a payment is made with a Visa credit card issued by Wells Fargo, the interchange collected from the merchant is ultimately paid to Wells Fargo. Credit card interchange can range from 1.5% + $0.10 to 3% + $0.10 per transaction depending on the merchant category code, credit card type, and transaction method. These are non-negotiable fees set by the card networks.

Assessment Fees: These fees go to the card network. So in the above example, Visa as the card network will receive the assessment fee. This type of fee ranges from 0.10% to 0.15% and is also a non-negotiable fee set by the card networks.

Processor Markups: These fees vary greatly depending on your payment processor and include the processor's rates, credit card transaction fees, chargeback fees, monthly fees, gateway fees, etc. These markups are typically 12-20% of the total processing costs paid by a merchant.

When a credit card payment is initiated by a consumer on the merchant's site, the merchant's acquiring bank receives the money, deducts the interchange fee for reimbursement to the issuing bank, passes the assessment fee along to the card network, and the processor markups are settled to the processor. The remainder is paid to the merchant.

For example, let's say a consumer purchases a pair of shoes using their Visa Rewards Signature card online for $100. Let's calculate how much the merchant ends up paying towards this purchase of $100. This card has an interchange fee of 2.7% + $0.10 ($2.80), an assessment fee of .15% ($0.15), and processor markups including $0.20 of fixed costs and 0.08% ($0.08) in variable costs. After those fees are divvied up, the merchant is left with $96.77 ($100 - $2.80 - $0.15 - $0.28). That is a whopping 3.23% for the transaction in this example.

3. Chargebacks and card-not-present (CNP) challenges

In addition to processing fees, merchants often face operational challenges and additional costs associated with chargebacks, transaction errors, and declines which are incredibly difficult to control.A chargeback is a reversal of a transaction that is ordered by the card-issuing bank as a result of potential fraud, a mistaken payment, or a successful consumer dispute. Chargebacks and fraud are amplified with card-not-present (CNP) transactions. Card numbers can be compromised in a number of ways and the potential for friendly fraud is far greater since there are very few ways to provide sufficient proof that a consumer did in fact make the purchase in question. This has forced merchants to implement more controls and inject additional costs in order to accept CNP transactions, leveraging third-party tools for fraud mitigation and chargeback management.

This drives the cost for payment acceptance up and the fraud impact to margins could be as high as 3.75%, even with fraud prevention costs per transaction of $0.50 per transaction. For every 1000 transactions of $100 each, you may end up paying $750 towards chargebacks and fraud prevention costs.

In addition, CNP transaction authorization rates are dramatically lower than card-present transactions. While some declines are addressable by the merchant, there are different factors that can cause a transaction to be declined, creating a poor customer experience and operational challenges in order to optimize authorization rates.

4. Millennials and Gen-Z don't prefer credit cards

Recent trends have shown that Millennials and Gen-Z don't prefer credit cards. According to Billtrust's research, more than half of Gen Z consumers (born between 1997 and 2012) do not plan to apply for a credit card at all. They also demand a superior experience which is lacking in credit card payments as compared to app-based and digital payment solutions. In Billtrust's survey, 46% of Gen Zers said they used mobile wallets like Apple Pay, Google Pay, and PayPal 1x to 5x each month. Bank transfers are also gaining momentum among Millenials and Gen Zers. Worldpay predicts that by 2022, bank transfers will be the most popular non-card based payment method in the U.S.With alternative payment options expanding and growing in popularity, many U.S. merchants are taking a hard look at the costs, risks, and realities of accepting cards.

5. What are alternative payment methods?

Due to the rising cost of credit cards and chargebacks, merchants are increasingly looking for other alternative payment methods (APMs), including online bank payments, alternative financing, peer-to-peer (P2P), cryptocurrency, and loyalty points. Millennials and Generation Z consumers are also more open to adopting alternative payment methods for a better experience.Where online payments used to be synonymous with credit card payments, P2P payments, alternative financing, and bank transfers are gaining traction. Online banking payments are a compelling alternative to achieve revenue optimization given their lower-than-debit cost and higher approval rate than card-based payments, while also providing a great customer experience.

Checkout optimization is critical for merchants. Lengthy forms lead to cart abandonment. According to Barilliance, the three drivers of cart abandonment were unexpected costs, how long it took to check out, and required fields in forms.

The checkout experience: credit cards vs. online banking payments provided by Trustly:

Online banking payments work well for merchants that need to reduce friction and enhance security at the same time. Trustly's PayWithMyBank®️ includes one-click checkout and strong customer authentication (SCA) features, with customers logging into their bank accounts and entering their credentials from memory.

Trustly provides a seamless user experience with intelligent payment technology which lowers payment processing costs and increases transaction approval rates. Merchants and consumers alike can depend on our platform for safe and secure payments.

Trustly's iOS and Android easy-to-deploy software development kits (SDKs) make it the perfect addition to your payment lineup. Due to COVID-19, consumers are increasingly making online and mobile payments, and providing a frictionless payment experience is critical for businesses going forward.

If you want to learn more about how to lower your payment processing costs while increasing your approval rates, take a look at Trustly's whitepaper, How to Lower Your Payment Processing Costs and Increase Approval Rates.

Host a Webinar with the MRC

Help the MRC community stay current on relevant fraud, payments, and law enforcement topics.

Submit a Request

Publish Your Document with the MRC

Feature your case studies, surveys, and whitepapers in the MRC Resource Center.

Submit Your Document